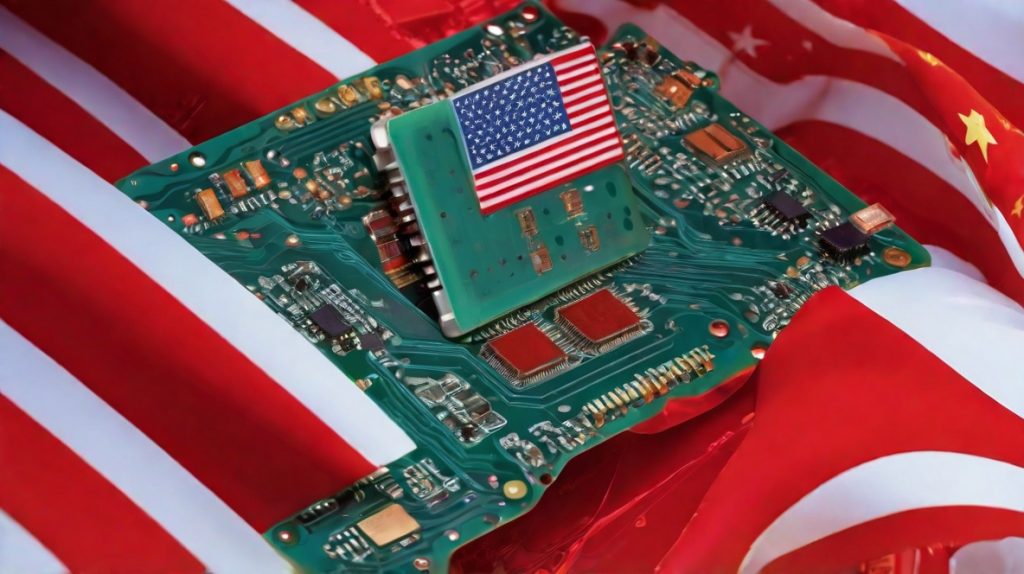

The United States has taken a significant step towards restricting American investments in key Chinese technology sectors, particularly artificial intelligence (AI), computer chips, and quantum computing. On Friday, June 21, 2024, the U.S. Department of the Treasury released detailed draft rules stemming from President Joe Biden’s executive order signed in August 2023. This move is part of a broader strategy to limit China’s access to advanced technologies that could potentially enhance its military, intelligence, surveillance, and cyber capabilities.

The proposed regulations target investments in China, Hong Kong, and Macau, which have been identified as “countries of concern” in Biden’s executive order. The rules aim to implement what Treasury officials describe as “a narrow and targeted national security program” focused on certain outbound investments in these areas.

Treasury Assistant Secretary for Investment Security Paul Rosen explained the rationale behind the proposal: “This proposed rule advances our national security by preventing the many benefits certain U.S. investments provide – beyond just capital – from supporting the development of sensitive technologies in countries that may use them to threaten our national security.”

The draft rules outline specific prohibitions and notification requirements for U.S. investors. For instance, they would ban American investors from funding AI systems in China that could be used for military applications such as weapons targeting, combat, and location tracking. Additionally, the rules would require notification for transactions related to the development of AI systems or semiconductors not otherwise prohibited.

The proposal includes a range of exceptions to balance national security concerns with economic interests. These exceptions cover:

- Publicly traded securities, such as index funds or mutual funds

- Certain limited partnership investments

- Buyouts of country-of-concern ownership

- Transactions between a U.S. parent company and a majority-controlled subsidiary

- Binding commitments that pre-date the order

- Certain syndicated debt financings

- Transactions deemed to be in the U.S. national interest

The Treasury Department has emphasized that these rules are designed to be targeted and focused, rather than a broad decoupling from the Chinese economy. However, the move reflects growing tensions between the two nations and the Biden administration’s efforts to maintain a technological edge over China.

The proposed regulations are open for public comment until August 4, 2024, after which the Treasury Department is expected to issue a final rule. This timeline puts the U.S. on track to implement the regulations by the end of the year, as initially anticipated.

Laura Black, a former Treasury official and current lawyer at Akin Gump in Washington, commented on the implications of the proposed rules: “U.S. investors will need to engage in more extensive due diligence when making investments in China or investments involving Chinese companies that operate in the covered sectors.” She also noted that the rules would keep “U.S.-managed private equity and venture capital funds in the cross-hairs, as well as some U.S. limited partners’ investments in foreign managed funds and convertible debt.”

The scope of the regulations extends beyond direct investments in China. Certain Chinese subsidiaries and parents will be covered under the rule, which would also prohibit some investments by U.S. companies in third countries. The rules also align with existing restrictions on exporting certain technologies to China, such as advanced semiconductors.

Those who violate the rules could face both criminal and civil penalties, and investments could be unwound. This underscores the seriousness with which the U.S. government is approaching the issue of technology transfer to China.

The Biden administration’s move is part of a larger strategy to maintain U.S. technological supremacy and prevent China from dominating emerging sectors. This includes recent actions such as placing stiff tariffs on Chinese electric vehicles (EVs) and blocking a Chinese-backed cryptocurrency mining firm from owning land near a Wyoming nuclear missile base due to national security concerns.

The proposed investment restrictions come at a time of heightened tensions between the United States and China. Relations between the two countries have been strained since February 2023, when the U.S. military shot down a suspected Chinese spy balloon off the East Coast after it traversed sensitive military sites across North America. This incident led to threats of repercussions from China and has contributed to a series of national security-related incidents between the two nations.

The Treasury Department has stated that it has engaged with U.S. allies and partners about the goals of the investment restrictions. They noted that the European Commission and United Kingdom have begun to consider whether and how to address outbound investment risks, suggesting a potential alignment of policies among Western nations.

The proposed rules reflect a delicate balance between national security concerns and maintaining economic ties with China, the world’s second-largest economy. While the Biden administration has insisted it has no interest in “decoupling” from China, these regulations represent a significant step towards more controlled engagement in critical technology sectors.

As the August 4 deadline for public comments approaches, the business community, policymakers, and international observers will be closely watching the development of these rules. The final regulations could have far-reaching implications for U.S.-China relations, global technology development, and the future of international investment in sensitive sectors.

The proposed investment restrictions also have political implications domestically in the United States. Both President Biden and his Republican presidential opponent are attempting to demonstrate to voters their ability to stand up to China, a major geopolitical rival and trading partner. The outcome of this policy initiative could play a role in shaping the narrative around U.S.-China relations in the upcoming presidential election.

As the world becomes increasingly reliant on advanced technologies like AI, quantum computing, and semiconductors, the stakes of this regulatory effort are high. The final form of these rules will likely have a significant impact on the global technology landscape, international investment patterns, and the ongoing competition between the United States and China for technological supremacy.

The U.S. Treasury’s proposed rules on investment in Chinese technology sectors represent a significant shift in U.S. policy towards China. While aiming to protect national security interests, these regulations also signal a new era of more cautious and controlled engagement between the world’s two largest economies in critical technology areas. As the process moves forward, the global business community and policymakers will be watching closely to see how these rules evolve and what impact they will have on the future of U.S.-China relations and the global technology landscape.

Copyright©dhaka.ai

tags: Artificial Intelligence, Ai, Dhaka Ai, Ai In Bangladesh, Ai In Dhaka, Claude, Future of AI, Quantum Computing