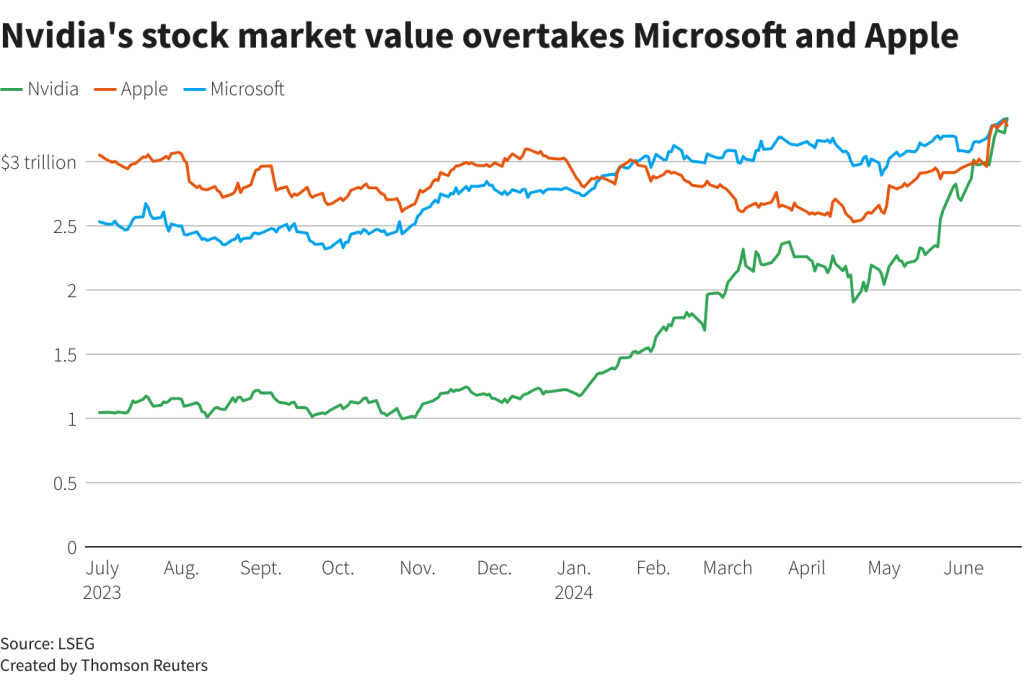

Nvidia, the Silicon Valley chipmaker, has etched its name in history, becoming the world’s most valuable company, surpassing tech titans Apple and Microsoft. In a stunning display of market dominance, Nvidia’s shares soared by 3.5% on Tuesday, propelling its market capitalization to an astonishing $3.335 trillion, eclipsing Microsoft’s $3.317 trillion and Apple’s $3.286 trillion.

This monumental achievement is a testament to Nvidia’s pivotal role in the AI revolution sweeping across the globe. As the demand for cutting-edge processors capable of powering generative AI skyrockets, Nvidia has emerged as the undisputed leader, leaving its competitors in the dust.

Jensen Huang, Nvidia’s visionary founder and CEO, prophetically stated during his keynote speech at the Computex tech trade fair in Taiwan earlier this month, “Today, we’re at the cusp of a major shift in computing. The intersection of AI and accelerated computing is set to redefine the future.” Nvidia’s meteoric rise is a clear validation of Huang’s foresight and the company’s unwavering commitment to AI innovation.

Nvidia’s journey to the top has been nothing short of remarkable. Founded in 1993 with a mission to bring 3D graphics to the gaming industry, the company’s fortunes took a dramatic turn after its invention of the graphics processing unit (GPU) in 1999. Today, it is Nvidia’s chips – built to power generative AI – that are fueling the company’s extraordinary ascent.

According to a Reuters report, Nvidia’s shares have skyrocketed more than 170% this year and have risen a staggering 1,100% since their October 2022 low. The company’s market value expanded from $1 trillion to $2 trillion in just nine months in February 2024, and it took a mere three months to reach the coveted $3 trillion mark in June 2024.

Amid this AI frenzy, tech giants like Microsoft, Meta Platforms, Google-owner Alphabet, and even Apple are racing to bolster their AI computing capabilities. Last week, Apple announced plans to integrate AI, including ChatGPT, into its mobile and desktop operating systems, as well as its Siri personal assistant.

However, Nvidia is currently winning the AI chip race, with a host of major customers – including Amazon Web Services (AWS), Dell Technologies, Google, Meta, Microsoft, OpenAI, Oracle, Tesla, and xAI – all planning to harness the power of its “processor for the generative AI era” in their cloud computing services and AI offerings.

In a strategic move to accelerate the adoption of generative AI in the enterprise sector, Nvidia has partnered with Hewlett Packard Enterprise (HPE) to introduce the Nvidia AI Computing by HPE, a portfolio of co-developed AI solutions. A key component of this portfolio is the HPE Private Cloud AI, which seamlessly integrates Nvidia’s AI computing, networking, and software with HPE’s AI storage, compute, and the HPE GreenLake cloud.

Antonio Neri, HPE’s president and CEO, expressed his enthusiasm for the collaboration, stating, “To unleash the immense potential of generative AI in the enterprise, HPE and Nvidia co-developed a turnkey private cloud for AI that will enable enterprises to focus their resources on developing new AI use cases that can boost productivity and unlock new revenue streams.”

Huang echoed Neri’s sentiments, adding, “Generative AI and accelerated computing are fueling a fundamental transformation as every industry races to join the industrial revolution. Never before have Nvidia and HPE integrated our technologies so deeply – combining the entire Nvidia AI computing stack along with HPE’s private cloud technology – to equip enterprise clients and AI professionals with the most advanced computing infrastructure and services to expand the frontier of AI.”

Nvidia’s ascent to the top has been nothing short of meteoric, with its stock ending Tuesday’s trading day at nearly $136, up 3.5%, making it more valuable than fellow tech giant Microsoft. It had earlier surpassed Apple earlier this month, cementing its position as the world’s most valuable company.

Chris Penrose, global head of business development for telco at Nvidia, predicted further growth in the sector during an event in Copenhagen, stating, “The generative AI journey is really transforming businesses and telcos around the world. We’re just at the beginning.”

Analysts at Wedbush Securities concurred, noting, “We believe over the next year the race to $4 trillion market cap in tech will be front and center between Nvidia, Apple, and Microsoft.”

However, not all commentators are convinced of Nvidia’s future gains, citing the increasing competition the company faces. Despite this skepticism, Nvidia’s dominance in the “new gold or oil in the tech sector” – the chips needed for artificial intelligence (AI) – is undeniable.

Nvidia’s rise to prominence has been nothing short of spectacular. Eight years ago, the stock was worth less than 1% of its current price. Back then, Nvidia’s value stemmed from its competition with rival AMD in the race to produce the best graphics cards.

In recent years, however, Nvidia has benefited tremendously from the boom in demand for chips that train and run generative AI models, the most well-known being OpenAI’s ChatGPT. The company also reaped significant rewards from the rush to mine Bitcoin in 2020, which saw a sharp uptick in sales of its graphics cards.

The rise and rise of the tech giant have been mirrored by the increasingly high profile of its boss, Jensen Huang. Meta boss Mark Zuckerberg even referred to the 61-year-old electrical engineer – known for his signature leather jacket – as the “Taylor Swift of tech” for the celebrity status he has achieved.

Huang’s popularity, particularly in his native Taiwan, has reached rock star levels, with fans treating him like a celebrity, posing for photos and even asking him to sign body parts.

Competition among AI developers is fierce, with tech heavyweights like Microsoft, Google-owner Alphabet, Meta, and Apple all battling to create a world-beating product. This competition benefits Nvidia, which not only develops its own AI tech but also dominates the vast majority of the AI chip market.

Nvidia’s sales and profit figures have consistently surpassed analyst expectations in recent years. In May, after the company’s latest set of financial results were published, Quilter Cheviot technology analyst Ben Barringer said Nvidia had “once again cleared a very high hurdle.”

“Demand is showing no signs of switching off either,” he added.

While a minority of analysts remain cautious, with Barclays credit analyst Sandeep Gupta arguing in February that Nvidia’s large market share would be hard to maintain given the increasing number of rivals and questioning how Nvidia’s customers would monetize AI software, the company’s current dominance in the AI chip market is undeniable.

As the AI revolution continues to reshape industries and redefine the future, Nvidia’s ascent to the pinnacle of the tech world is a testament to its relentless pursuit of innovation, its unwavering commitment to pushing the boundaries of what’s possible, and its ability to capitalize on the transformative power of artificial intelligence.

Copyright©dhaka.ai

tags: Artificial Intelligence, Ai, Dhaka Ai, Ai In Bangladesh, Ai In Dhaka, Claude, Future of AI, Apple,Nvidia